RBI MPC Meeting: On Thursday, August 8, 2024, Reserve Bank of India Governor Shaktikanta Das will announce the decisions taken in the Monetary Policy Committee meeting. And there is a high possibility that in this Monetary Policy Committee meeting also RBI will not make any change in its policy rates.

Inflation still remains a challenge for the Reserve Bank of India and the Consumer Price Index i.e. retail inflation rate is still above the RBI’s target of 4 percent. In June 2024, the retail inflation rate has again crossed 5 percent and reached 5.08 percent. In which the major contribution goes to the jump in food inflation which has reached 9.36 percent. In June 2023, the food inflation rate was 4.31 percent. The prices of vegetables and pulses have increased the headache of RBI. In June, the inflation rate of vegetables was 29.32 percent and that of pulses was 16.07 percent.

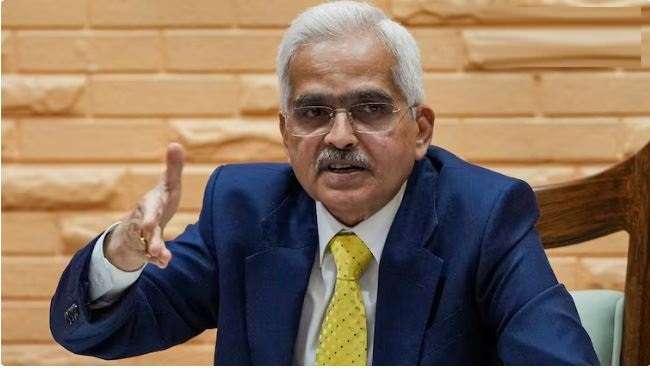

Just last month, Governor Shaktikanta Das had said that it is too early to talk about interest rate cuts due to instability in the economic environment and inflation rate being above 5 percent. He said, there is uncertainty in the economic situation in the whole world including India, so it is not right to talk about interest rate cuts right now. Shaktikanta Das said that RBI has set a target of bringing the inflation rate down to 4 percent and the inflation rate remains above 5 percent.

After the retail inflation rate went up to 7.80 percent in May 2022, the Reserve Bank of India started raising policy rates to control inflation and increased the repo rate from 4 percent to 6.50 percent by February 2023. The repo rate was increased by 250 basis points in 10 months, making EMI expensive.

The repo rate has remained stable since April 2023. Different countries are seeing different pictures regarding interest rates. The Bank of England has cut interest rates, the Federal Reserve is likely to cut them in September, while the Bank of Japan has raised interest rates. Everyone will be waiting to see what decision the RBI takes. But experts believe that interest rates can be reduced in India from the fourth quarter of the current financial year 2024-25.